3 Which of the Following Statements Characterizes an Operating Lease

Which of the following statements characterizes an operating lease. Ot Question 18 03 pts Which of the following statements characterizes an operating lease.

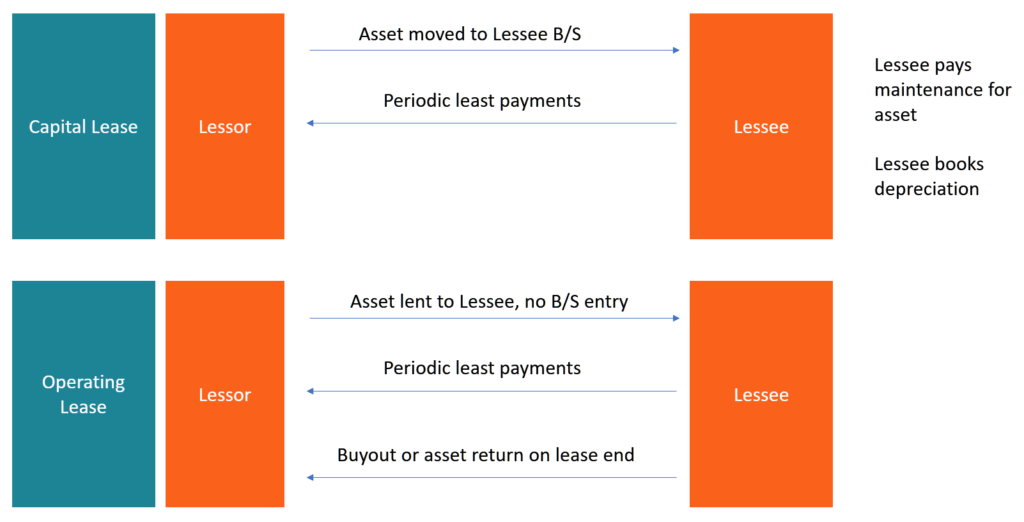

Capital Lease Vs Operating Lease What You Need To Know

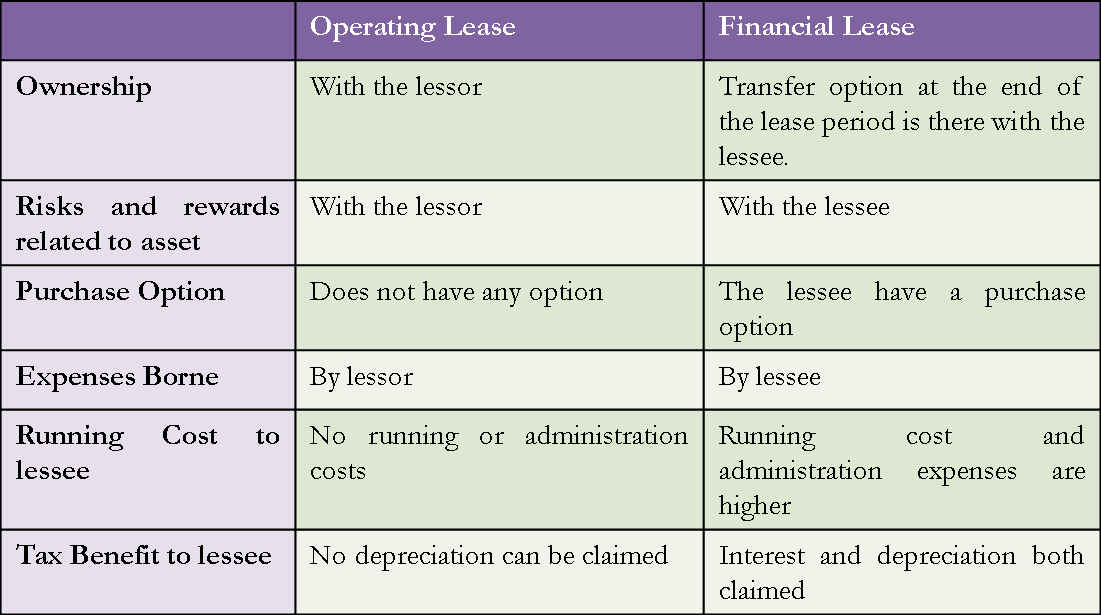

The benefits and risks of ownership are transferred from the lessor to the lessee.

. 2 For an operating lease the lessor maintains the leased asset. The lessor transfers title at the end of the lease term. D The lessee has an option to purchase the leased assets and is reasonably sure to exercise the option.

Which of the following statements best characterizes operating leases. The lessee records leased property as an asset and the present value of the lease payments as a liability. The lessee records depreciation and interest.

Which of the following statements best characterizes operating leases. The benefits and risks of ownership are transferred from the lessor to the lessee. The lessor records depreciation and lease.

A The lessee reports cash outflows as financing activities. The lessor transfers title of the leased property to the lessee for the duration of the lease term. Which of the following statements characterizes an operating lease.

The lessor records depreciation and lease revenue. The lessors interest rate always is higher than in a finance lease. Asset and a liability.

The shorter of the physical life of the asset or the lease term. The lessor records depreciation expense and lease revenue. Lease Y does not contain a bargain purchase option but the lease term is equal to 90 percent of the estimated economic life of the leased property.

The shorter of the physical life of the asset or the lease term. Operating leases transfer ownership to the lessee contain a bargain purchase option are for more than 75 of the leased assets useful life or. The lessor records depreciation and lease revenue The lessor transfers title at the end of the lease term.

Which of the following statements best characterizes operating leases. The lessor records depreciation and lease revenue. The lessor treats the lease as an operating lease.

Which of the following statements characterizes an operating lease. Which of the following statements characterizes an operating lease. AThe lessor recognizes only interest revenue over the life of the asset.

Which of the following statements characterizes an operating lease. The lessee records depreciation and interest. When a lease qualifies as a capital lease what is the cost basis of the asset acquired.

On January 1 2018 Gibson Corporation entered into a. The lessee also is the seller. Which of the following statements best characterizes operating leases.

Which of the following statements characterizes a sales-type lease. Capital Lease Operating Lease a. The lessee records a leased asset.

Which of the following statements characterizes an operating lease. BThe lessor recognizes only interest revenue over the lease term. The lessor records depreciation and lease revenue.

The lessee records leased property as an asset and the present value of the lease payments as a liability. The lessor records depreciation and lease revenue. Lease Z does not transfer ownership of the property to the lessee by the end of the lease term but the lease term is equal to 75 percent of the estimated economic life of the leased property.

The lessee records leased property as an asset and the present value of the lease payments as a liability. Which of the following statements best characterizes operating leases. C The lessor transfers title at the end of the lease term.

The lessor records depreciation and lease revenue. Which of the following statements characterizes a sale-leaseback arrangement. The lessor transfers title of the leased property to the lessee for the duration of the lease term.

The lessee records amortization expense and interest expense. CThe lessor recognizes a dealer profit at lease inception and interest revenue over the lease term. The present value of the monthly lease payments equaled 80 of the.

The lessee records depreciation and interest. Expense over its useful life to the lessee which will be. Lessee and Lessor 1 For an operating lease the lessee is only required to report rent expense on its income statement.

The lessee records leased property as an asset and the present value of the lease payments as a liability. C The lessee has an option to purchase the leased assets and. Operating leases transfer ownership to the lessee contain a bargain purchase option are for more than 75 of the.

The lessor records depreciation and lease revenue. When equipment held under an operating lease is subleased by the original lessee the original lessee would account for the sublease as a. The lessee records the lease obligation related to the leased asset.

B The lessor records depreciation and lease revenue. Direct financing lease d. Sales type lease b.

The lessee does not record a right-of-use asset. When a lease qualifies as a capital lease what is the cost basis of the asset acquired. The present value of the minimum lease payments exclusive of.

B The lessor records depreciation and lease revenue. It is the date on which the lessee is entitled to exercise the right of use the leased asset. The lessor transfers title at the end of the lease term.

On canary 1 year 4 molar co signed a 7 year lease for equipment having a 10 year economic life. The lessee records depreciation and interest. The lessee records the lease obligation related to the leased asset.

The benefits and risks of ownership are transferred from the lessor to the lessee. Which of the following statements characterizes an operating lease. The lessee records depreciation and interest.

Which of the following statements characterizes an operating lease. A The lessee reports cash outflows as financing activities. Inception of the lease b.

The lessor records lease revenue asset depreciation maintenance etc and the leases records lease payments as rental expense. The lessor transfers title of the leased property to the lessee only for the duration of the lease term. Equal monthly rental payments for a particular lease should be charged to Rental Expense by the lessee for which of the following.

A direct financing lease is classified in the lessors balance sheet as. The lessee buys the asset from a third party. The lessee records a leased asset.

For operating leases the lessee records rent expense and the lessor would record the related revenue and would amortize the asset. 183 Accounting for Operating Leases. Which of the following statements characterizes an operating lease.

Ifrs 16 Leases Accounting Principles Finance Lease Lease

Ias 1 Presentation Of Financial Statements Cash Flow Statement Cash Flow Financial

Difference Between Operating Versus Financial Capital Lease Efm

Comments

Post a Comment